How India Finances Its Cities

Home to over 800 million people, India’s cities generate most of the country’s economic output — but operate on less than 0.77% of GDP in public finance.

India’s cities are at the centre of the country’s economic future, but as millions move into cities each year, the demand for infrastructure, services, and resilient local governments continues to grow. Adequate and predictable public finance has become the single biggest constraint facing Urban Local Governments.

The Finance Commission, a constitutional body mandated to design India’s fiscal transfers, has played a transformative role in reshaping urban finance over the last two decades. Janaagraha has worked with the XIII, XIV, XV and XVI Finance Commissions to strengthen urban devolution, catalyze governance reforms, and build a more sustainable financial future for India’s cities.

Why the Finance Commission matters for India’s cities

Urban India already has a substantial share of the population — and an even larger share of economic activity. These cities are governed by more than 4,800 Urban Local Governments (ULGs) of varying sizes and capacities. But the fiscal foundations on which these cities operate remain fragile.

Even without comprehensive bottom-up estimates of urban infrastructure and service delivery needs, available evidence clearly shows that cities’ investment needs far exceed the funds currently at their disposal. Municipal revenues are insufficient to meet both existing service backlogs and the demands of rapid urbanization.

According to the World Bank (2022), Indian cities require USD 840 billion in capital investment over the 15-year period leading up to 2036, equivalent to USD 108 per capita per year.

In contrast, between 2011 and 2018, urban capital spending averaged only USD 10.6 billion annually, or about USD 26 per capita per year — nearly four times lower than what is required. All municipal revenues combined amount to less than 0.77% of GDP, far below the HPEC benchmark of 1.71%.

Cities have responsibilities, but not revenues

The roots of this imbalance lie in India’s model of fiscal decentralization.

While the 74th Constitutional Amendment assigned a wide range of functions to ULGs, it did not provide commensurate revenue powers. Under Article 243X, states retain substantial control over the design, rates, exemptions, and administration of municipal taxes. Over time, this has constrained cities’ ability to strengthen their own revenue base.

As a result, municipal own-source revenues remain modest.

Nearly one-third of city revenues come from grants. In principle, states are expected to bridge this gap through State Finance Commissions (SFCs) under Article 243Y, which recommend principles for sharing state revenues with local governments. In practice, SFCs are often delayed, unevenly implemented, or only partially accepted by states.

What does the Union Finance Commission do?

Constitutionally established under Article 280, the Union Finance Commission (UFC) is the only institution mandated to periodically assess how public funds are shared across different levels of government. It recommends transfers that address:

- Vertical imbalances (between the Union and the states)

- Horizontal imbalances (between different States)

Unlike most Union urban schemes — which are sector-specific, tightly tied, and limited in geographic reach — Finance Commission transfers reach all urban local governments across India, making them central to the functioning of India’s urban system.

The evolution of Finance Commission’s support to cities

The last three decades have shown a profound shift in both scale and intent. The X Finance Commission (1995–2000) made the first-ever allocation to cities — ₹1,000 crore. This was a small, largely ad hoc transfer, routed through states, with no defined share of the divisible pool.

By the XIII Finance Commission (2010–15), urban grants had reached ₹23,111 crore, accounting for 0.51% of the divisible pool. For the first time, 35% of urban grants were performance-linked, tying fund release to improvements in municipal accounting, budgeting, and fiscal discipline.

The XIV Finance Commission (2015–20) significantly expanded urban devolution. Allocations rose to ₹87,144 crore, nearly four times the previous one. Performance grants were retained at 20% of urban allocations, with conditions streamlined around these reforms

- Publication of audited accounts

- Increases in own-source revenues

- Disclosure of service-level benchmarks

The most consequential leap came with the XV Finance Commission (2021–26). Urban grants increased to ₹1.55 lakh crore, equivalent to 1.5% of the divisible pool and accounting for 36% of total local government grants — the highest urban share in Finance Commission history.

The XV FC also introduced a differentiated grant architecture, recognising that Million-Plus Cities and smaller ULGs face fundamentally different fiscal capacities and development challenges. Accountability was strengthened through mandatory eligibility conditions for all urban grants, including the publication of audited annual accounts, improvements in property tax systems, and the constitution and functioning of State Finance Commissions.

The impact was unprecedented:

- Over 96% of ULGs published audited accounts

- 11 states constituted SFCs following these reforms

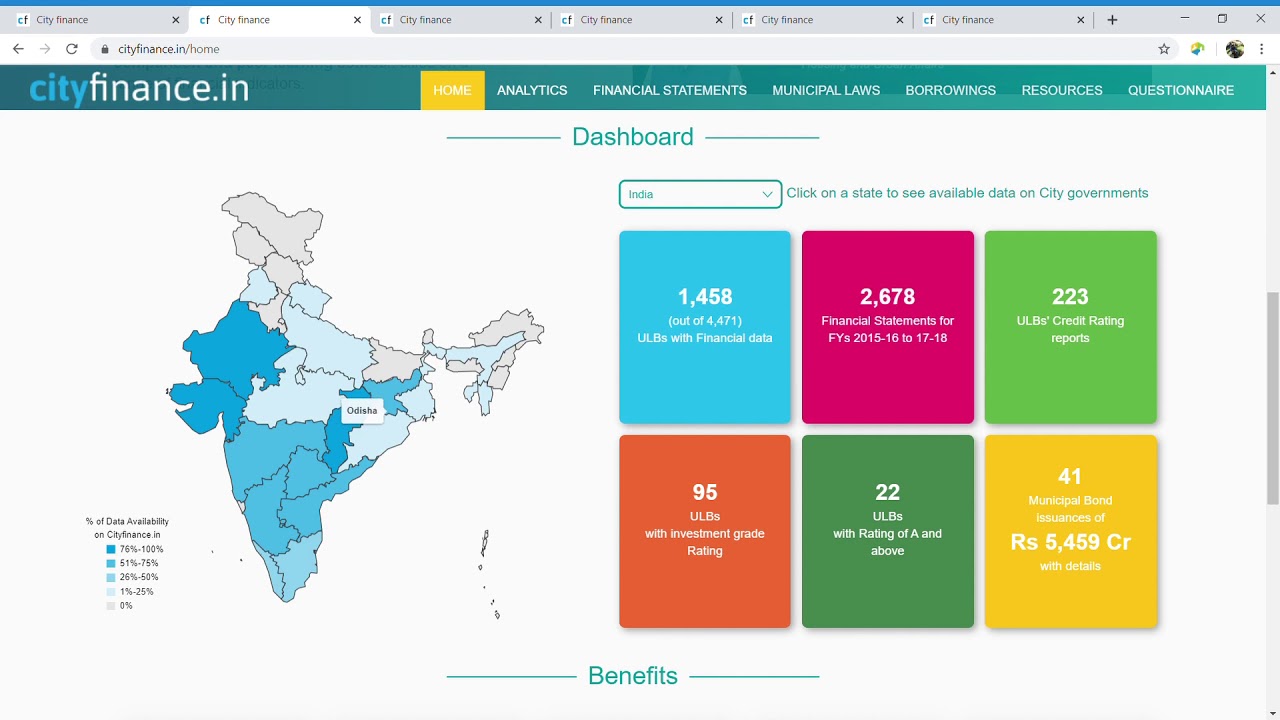

This period also saw the institutionalization of digital public infrastructure for urban finance, including digital grant administration through CityFinance.

Janaagraha and the Finance Commission

Strong city finances are fundamental to effective urban governance. Janaagraha works with the Union Finance Commission because it plays a central role in how India’s cities are financed. Finance Commissions help bridge the funding gap faced by Urban Local Governments and provide some of the largest and most predictable sources of funding for cities.

Janaagraha’s engagement began with the XIII Finance Commission, contributing recommendations on municipal accounting and audit systems. This continued with the XIV Finance Commission, including presentations on municipal finance challenges and collaboration with national audit institutions to shape reforms on audited municipal accounts.

We formally engaged with the XV Finance Commission and continue with the XVI Finance Commission through Memoranda of Understanding, supporting the Commission’s work through research and analytical studies on municipal finance and urban governance.

As part of this engagement, Janaagraha has participated in multiple full-Commission meetings with the XVI Finance Commission. We believe the XVI Finance Commission represents a significant milestone. It is expected to allocate an unprecedented quantum of funds to urban local governments.

A simpler and more transparent grant architecture — anchored in predominantly untied transfers, limited and functional conditionalities, and a differentiated approach across city sizes — can strengthen both fiscal efficiency and local accountability.

Looking ahead, future Finance Commissions will be critical to:

- Advancing the next generation of urban fiscal reforms

- Strengthening decentralization

- Improving financial reporting and data systems

- Addressing emerging challenges such as GST, urban expansion, and rural–urban transitions

At the heart of urban finance lies a simple goal: better services, stronger institutions, and more liveable cities for India’s citizens. The Finance Commission plays a defining role in enabling this transformation. Janaagraha remains committed to working with the Finance Commission to build stronger, more transparent, and more sustainable city finances and an empowered system of city governance.

VIDEO Gallery